Low cost carriers Ryanair, AJet and Pegasus Airlines recorded the largest seat increases in the former Yugoslav markets during the first half of the year compared to the same period in 2024, as the January - June window draws to a close. Air Serbia remained the region’s largest carrier, offering over 2.58 million seats during the six-month period, narrowly ahead of Ryanair. The budget airline’s growth was driven by expanded operations in Croatia and Sarajevo, adding an additional 350.954 seats year-on-year, representing an increase of 15.7%. Ryanair added the most capacity in Bosnia and Herzegovina, with an increase of 200.330 seats, driven by growth in both Sarajevo and Banja Luka. Croatia followed with an additional 164.306 seats. Montenegro was the only market to buck the trend, with the budget carrier reducing capacity by 44.300 seats.

Turkish rivals AJet and Pegasus Airlines were the second and third fastest-growing carriers in the former Yugoslav markets, adding 215.098 and 200.808 seats, respectively. AJet’s expansion was fuelled by the launch of more than half a dozen new routes that were not operational during the first half of 2024. Serbia was AJet’s fastest-growing market, with an additional 71.508 seats, followed closely by Bosnia and Herzegovina with 70,864 extra seats. In contrast, Pegasus Airlines saw its strongest growth in Macedonia, where it added 85.484 seats, followed by Bosnia and Herzegovina with 57.084 additional seats.

Fastest growing airlines in EX-YU in H1 2025

Among legacy carriers, KLM added the most capacity in the former Yugoslavia, driven by the launch of a new daily service to Ljubljana and increased capacity in both the Croatian and Serbian markets. Air Serbia retained its position as the region’s largest airline during the first half of the year, leading in both available seat capacity and number of operated flights. However, Ryanair followed closely behind.

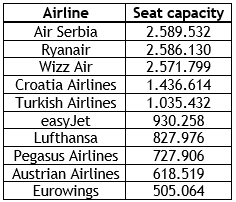

Largest airlines in EX-YU in Q1 2025

Who would have thought two Turkish airlines.

ReplyDeleteWith Pegasus and Ajet doing the same thing, market will get oversaturated.

DeleteNo opposite , especially Turkish carriers have a bright future on the Balkans because of the cheap tickets and good service

DeletePegasus for now becoming Skopjes 2th busiest carrier

Good service? On Pegasus and AJet? You must be joking.

Delete@12:30 what is wrong with their service ?

Delete12:30 what is wrong with their service ? Pegasus have one of the best rating service in Europe ;)

DeleteThird person here but it's just another LCC. Nothing special, I've seen far worse on some SEAsian LCCs and far better on basically every legacy carrier

DeleteNice to see that BiH is the driving force for growth for many of these airlines.

ReplyDelete+1

DeleteTurkish carriers are killing it

ReplyDeleteThere is even more room for expansion.

DeleteAnd none of the top three serve Slovenia :(

ReplyDeleteBravo Fraport!

DeleteOh no, no, no. You're not going to pin this on Fraport alone. Slovenia had decades to attract Ryanair but did nothing but repel it. I guess FR was good for Vienna, good enough for Venice, good for Dubrovnik, but not too good for SLO. Go figure!

DeleteYou cannot seriously compare VIENNA with Ljubljana? VENICE? One of the most famous destinations in the world? And also DUBROVNIK in the summer?

DeleteFR has no issue serving other Fraport operated airports but NOT LJU.

DeleteSo why did they leave FRA?

DeleteAlso left Athens for a short while but returned after they realised blackmail only works on tiny airports

DeleteATH is not operated by Fraport. Once again, the question was why did Ryanair leave FRA.

DeleteNumber of seats being added in ex-Yu is actually really low. I mean if Sun d'or with its flights to BEG and TGD is near the top of the list

ReplyDeleteTrue that

DeleteWhat equipment does Sun D'or use?

DeleteB737-800 and wet leased A320.

DeleteAnd they have a beautiful new livery :)

DeleteI like it too

DeleteTbf there's a lot ot charters from them, not just TGD and BEG

DeleteSkopje and Pegasus are amazing combination..

ReplyDeleteGreat to see KLM in the top. Hope they introduce Sarajevo next.

ReplyDeleteNope , SJJ will introduce flights to Middle east they obviosly no look for Europe flights :D

DeleteWhat a stupid comment. SJJ has introduced 13 new European routes in the last 12 months alone.

DeleteWhich one is European hub and flag carrier ?

Delete^ And how many European hub and flag carriers have added Skopje? I really don't know what your constant problem with Sarajevo is. Whenever someone comments about it you post several negative comments along with many praising SKP.

DeleteI really dont know also why on every article you are writing every airline need to go to Sarajevo :D :D

DeleteTransavia or KLM would be good, although of course KLM would be the better option.

DeleteDuring the last year SJJ has introduced more European routes than any other airport in the region.

DeleteGuys only difference is that Persian Gulf destinations can be served without subsidies and discounts. Flights to Western Europe only happened because SJJ and the government paid.

DeleteAt least in SKP Wizz Air flies to the West without subsidies.

"At least in SKP Wizz Air flies to the West without subsidies."

DeleteSure. LOL

Anyway, what does someone saying they hope KLM starts flights to SJJ have to do with Skopje? Other than the annoying guy from Macedonia who got triggered by that post (and he always gets trigerred by anything related to SJJ).

Skopje pays a lot of money to Wizz to maintain flights, they would cut all of their leisure lines the moment the cash flow stops. Sarajevo is paying miniscule money, not even a million euros annually while airports like Tuzla or Niš pay more.

Delete10:10 not all of Wizz routes are subsided so dont make scenario that all routes are payed, we all know that very well.Wizz still maintain good portion of routes without support. If bosnia didnt giwe money to Ryanair they will never go there ;)

Delete10:10 not all of Wizz routes are subsided so dont make scenario that all routes are payed, we all know that very well.Wizz still maintain good portion of routes without support. If bosnia didnt giwe money to Ryanair they will never go there ;)

DeleteRyanair are getting money for only 4 out of their 11 routes. The biggest draw was abolishing handling taxes

DeletePegasus hitting in Macedonia so hard , I hope to see they add some other routes to and from MKD in future

ReplyDeleteBy the end of the year Pegasus will have around 700k passengers from Skopje 🫣

ReplyDeleteThat is impossible with their current capacity levels, even if they had a 100% load factor on each flight.

DeleteJust goes to show the nonsense some people post in the comments.

DeleteLast year they finish with 330k , now probably around 500k ... my opinion , 700k is way too much

DeleteIf this trend continue for 2 years will reach 700k for sure.This year statistic says close to 500k which is still amazing numbers

DeleteThe airline has under 500.000 seats on the market for the whole of 2025.

DeleteExactly as I said close to 500k this year , and for the next probably close to 700k..

DeleteSo you expect them tp have 100% load factor and add more than 200,000 seats next year. What are you smoking?

DeleteNot next year I said two years and that is 2027 , their trend is as we see every year adding 100k so the real scenario is for 2 years they come close to 700k , whats not clear buddy?

DeleteYou are completely unrealistic. First you made up they have 700,000 passengers this year, then you made up they have 500,000 passengers this year.

Deletehahaha 700k ?!?! o.O that would be if 1 passenger is counted for flight during embarking and disembarking aircraft xD

DeleteThey will have we will see in the end of the year made up friend

Deletedude, cut the crap. Admin wrote you its impossible as qty of available seats is not that high. Maybe it will happen, and hopefully it happens, but not in next 3-4 years.

DeleteIts like we wrote SJJ will surpass SPU during this year due to Ryan and Wizz slash over there.. Maybe it happens in next 5-10 years maybe it never happens.

LCCs clearly winning the growth race. More competition is always welcome.

ReplyDeleteIt's the same situation all over Europe.

DeleteI wish we had serious LCC competition in BEG.

DeleteYou have Wizz Air based in BEG with 4 aircraft and a route network of 24 destinations.

DeleteI think Wizz Air has more destinations from BEG than they do from SOF.

DeleteIn BEG there is Wizz and then nothing apart form 1-2 routes with low frequencies here and there by the other LCCs.

DeleteBecause the market size is such that it cannot sustain more than that. Otherwise there would be more.

DeleteSeems that the market size is not the problem if we look at SOF, TIA, SKG and the diversity of LCCs serving them.

DeleteYou think the size od the Greek market is the same as in Serbia? Ok.... Albania and Bulgaria have almost non existant flag carriers that do not serve 86 destinations from their home airport. So it certainly makes things different for LCCs. Unlike Albania which has become a popular tourist destination and Bulgaria which is an EU member, Serbia is neither. Finally, no one forbids LCCs to launch routes. Obviously, they have concluded that next to Wizz and Air Serbia there isn't a sufficient market for them.

DeleteThe SKG market is perfectly comparable.

DeleteAlbania has become a popular tourist destination because so many LCCs started flying from TIA. Just 5 years ago TIA and Albania has as much tourism as Macedonia, maybe less.

DeleteWizz has 26 destinations from Belgrade and 28 from Sofia. No need to 'think' something which is easily checkable!

DeleteAnd Ryanair has 44 destinations from SOF.

DeleteAnd Ryanair has 44 destinations from SOF.

Delete@11.07. Yes, the Albanian coastline had nothing to do with tourism. Same as Thessaloniki and the number of holiday towns it is surrounded by. Some people and the utter nonsense they write fof the pure joy of spitting at anything related to Serbia.

DeleteAnd that's in addition to Ryanair's 44 destinations from Sofia!

Delete@12:23 we all know Albania got a coastline over the last 5 years. Before it didn't have one! 😂

DeleteIt is only in the last 5 years that the new airport operator has waived all fees to airlines.

Delete@13:35 no such thing has happened! So why lie?

DeleteAnonymous09:34 I wish we had serious LCC competition in BEG.

DeleteDosadio si svima.

I've noticed that Pegasus and AJet are now competing on many routes. I wonder if it is sustainable to have to players on all those flights or if one of them will beat the other.

ReplyDelete*two

DeleteTime will tell

DeleteThe top 3 largest airlines are so close. Interesting

ReplyDeleteRyanair dominates in summer but they are not huge in winter. Wizz Air has much more balanced year round network

DeleteNice growth from LH! How come they are adding so many seats?

ReplyDeletehttps://www.exyuaviation.com/2024/12/lufthansa-is-set-to-enhance-its.html

DeleteThank you

Deleteit would be interesting to see how much the Lufthansa group has in total.

ReplyDeleteSurprised to see Eurowings in the top 10 largest.

ReplyDeleteI was not expecting that.

DeleteWhere would Lufthansa be if the whole LH Group was counted together? Top 3?

ReplyDeleteThe way Lufthansa is buying up airlines it will be no 1 when you count all their investments.

DeleteBelgrade needs Ryanair for any serious further growth

ReplyDeleteThe expert has spoken

Delete@Anonymous 12:58

DeleteEveryone can see that apart form you.

Air Serbia 2023 growth proves those "academy" graduates are wrong.

DeleteBiH really stands out. Strong seat growth from all three top LCCs. Makes you wonder how much of that is sustainable demand versus subsidies.

ReplyDeleteA lot of the growth of being generated through subsidies

Delete*is being

DeleteInteresting data

ReplyDeleteGood to see OU finally recovering

ReplyDeleteIt took just 5 years...

DeleteHopefully finances will recover too

DeleteAnd load factor

DeleteMacedonia and Bosnia are now LCC battlegrounds.

ReplyDelete